How can we help you?

New IDCheck by Co-Op for Shared Branching

IDCheck is a new product that enables Credit Unions to more effectively validate the identity of guest members during Shared Branching transactions while minimizing the risk of potential fraud.

Effective May 1, 2025, Shared Branching users will be required to preload their state-issued driver’s ID into this application before visiting a participating Shared Branch location.

If you are a visiting Credit Union Shared Branching participant, please follow the instructions below to prepare for this transition.

If you are a Green Country FCU Shared Branching user planning to visit other Credit Unions within the network, please follow the instructions to ensure a smooth experience when conducting your Green Country transactions at other Credit Union branches

Here Is What You Can Expect From The New IDCheck:

When you arrive at the branch, or before, you will be asked to scan a QR code with your mobile device and follow the instructions on the screen to get a member verification code.

- Enter your Credit Union’s name – will be able to choose from a drop-down list.

- Enter your Member Number and last 4 digits of social security number.

- Take a picture of the front of your government-issued ID.

- Take a picture of the back of your government-issued ID.

ID is stored so this can be reused instead of taking a new photo every time.

- Take a Selfie

Selfie is stored so this can be reused instead of taking a new photo every time.

- You will be given a verification code – this code is good for 20 minutes and must be provided to the Teller prior to performing the transaction.

- Proceed to the Teller and provide them with your verification code

- Complete transaction as normal

If you are not able to get a verification code this does not mean your transaction can not be performed. The teller may be able to verify you by means other than the IDCheck system.

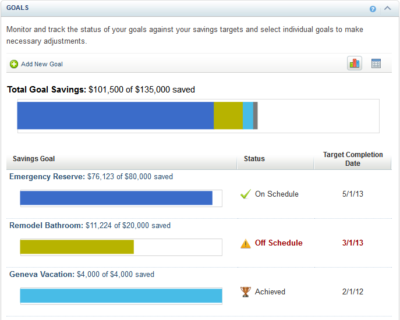

HOW TO: SET A GOAL

- Login to Online Banking and Click on Money Manager

- Inside Money Manager, click on GOALS

- Click on the Green Plus – ADD NEW GOAL

![]()

- Add details – name it, give it an amount and a timeframe, then select the account you want to use for the goal (this can be multiple accounts)

![]()

- Now that your tracking is set up – set up an automated transfer to help fund your goal. **Money Manager does not move money or set an recurring deposits/withdrawals – you have to do that through online banking. Money manager simply shows you where your money is going and allows you to easily track and analyze.

![]()

![]()

Learn More about Money Manager: https://www.greencountryfcu.com/faq-items/money-manager/

A Share-Secured Loan is a great way to build credit if you don’t have a credit history, or if you need to improve your credit score.

Direct Depositing your paycheck into your Green Country account means you have access to your money faster.

Direct deposit refers to the deposit of funds electronically into a bank account rather than through a physical, paper check. Direct deposit requires the use of an electronic network (called the automated clearing house or ACH) that allows deposits to take place between banks and credit unions. Because the funds are transferred electronically, recipients’ accounts are credited automatically, so there is no need to wait for the money to clear. Common uses for direct deposit include paychecks and tax refunds.

Direct deposit requires a signature on a specific form to setup. Fill out this Direct Deposit form and submit to [email protected] or drop off at your local Green Country branch.

If you have the online banking link saved or bookmarked in your web browser, you will need to update that link after August 17th. Here’s the new online banking address: https://online.greencountryfcu.com.

Existing User Online or on Mobile

Signing into our enhanced online banking system is different. If you are currently signed up (existing user) for online banking, these are the steps you will need to follow:

- Use your Current User ID for login. Your password will be the last six digits of the primary’s social security number.

- Don’t know your login ID? Text or call us at (918) 245-1301 during business hours.

- Review the terms and conditions, click the box, and hit continue.

- You will then need to change your password.

- You will then be verified via phone call or text message with our phone number on file.

- After the phone call or text message, you will enter the verification code provided and then hit the verify button.

- You will then need to answer 5 security questions

If you’re a new user, there are two ways to sign up online:

- Online

- On the Mobile App

New User Online:

- Go to https://www.GreenCountryFCU.com/

- Click on the Enroll in Online Banking link

- Fill out the fields – your member ID is your account number – and click enroll

- Accept the Terms & Conditions

- Create a User ID and new Password

- User ID must be at least 6 characters

- Passwords must include one upper case, one lower case, one number and one special character and be between 9 and 32 characters long.

- After enrolling, you’ll be prompted to login with your newly created User ID and password

- Setup Phone for Identity Verification

- Validate your enrollment with the one-time passcode or phone number feature

- Select and answer 5 security questions and save

The steps are the same on your mobile device once you’ve downloaded the latest App.

- Download mobile APP for iPhones

- Download mobile APP for iOS Tablets

- Download mobile APP for Android/other devices

If you have the online banking link saved or bookmarked in your web browser, you will need to update that link on August 17th. Here’s the new online banking address: https://www.greencountryfcu.com.

Existing User Online or on Mobile

Signing into our enhanced online banking system is different. If you are currently signed up (existing user) for online banking, these are the steps you will need to follow:

- Use your Current User ID for login. Your password will be the last six digits of the primary’s social security number.

- Don’t know your login ID? Text or Call us at (918) 245-1301

- Review the terms and conditions, click the box, and hit continue.

- You will then need to change your password.

- You will then be verified via phone call or text message with our phone number on file.

- After the phone call or text message, you will enter the verification code provided and then hit the verify button.

- You will then need to answer 5 security questions

If you’re a new user, there are two ways to sign up online:

- Online

- On the Mobile App

New User Online:

- Go to https://www.GreenCountryFCU.com/

- Click on the Enroll in Online Banking link

- Fill out the fields – your member ID is your account number – and click enroll

- Accept the Terms & Conditions

- Create a User ID and new Password

- User ID must be at least 6 characters

- Passwords must include one upper case, one lower case, one number and one special character and be between 9 and 32 characters long.

- After enrolling, you’ll be prompted to login with your newly created User ID and password

- Setup Phone for Identity Verification

- Validate your enrollment with the one-time passcode or phone number feature

- Select and answer 5 security questions and save

The steps are the same on your mobile device once you’ve downloaded the latest App.

- Download mobile APP for iPhones

- Download mobile APP for iOS Tablets

- Download mobile APP for Android/other devices

Zelle® is a fast, safe and easy way to send and receive money with friends and family who have a U.S.-based checking or savings account – typically in minutes when both users are already enrolled. With just an email address or U.S. mobile number, you can send money to people you know and trust, regardless of where they bank.

Learn more about Zelle.

There are a number of ways to transfer money between Green Country accounts and other financial institution accounts inside Online Banking and our Mobile Banking apps.

Transfers to external accounts have two options using the ACH (Automated Clearing House process.

- Standard (3-day)

- Next Day (1-day) – $2.50

You can also transfer money internally, between your existing Green Country accounts, as well as another Member’s accounts inside Online and Mobile Banking, for example if you have a child in college and need to send them money one-time, or even weekly/monthly. Those transfers are immediate.

If, when you login to online/mobile banking, you do not see the option to transfer money externally, please text or call us at (918) 245-1301.

Quickly get your account balance(s), history or find an ATM or branch near you – all with a text message on your mobile phone.

TEXT to 39872

- Balance: Text ‘BAL’ to 39872

- Command Help: Text ‘HELP’ to 39872

- See last 3 transactions: Text “HIST + account nickname” to 39872

**if you need actual account help instead of self-service alerts, please use our customer service text line (918) 245-1301**

Activate text alerts by going to Mobile inside Online Banking. Under Manager your mobile devices, add your mobile phone, then again under “other services” and agree to the terms and conditions provided. That’s it! You’re enrolled.

Green Country FCU offers members mobile access to account information (e.g., for checking balances and last transactions) over SMS, as well as the option to set up alerts for accounts (e.g., low balance alerts). Enrollment requires identification of the user’s banking relationship as well as providing a mobile phone number. The mobile phone number verification is done by the user receiving an SMS message with a verification code which they will have to enter on the website. Additionally, members may select the type of alerts and other preferences which will determine, together with their account data, the frequency of alerts delivered to the customer. This program will be ongoing. Message & Data rates may apply. Members can opt-out of this program at any time.

Questions about Text Alerts?

- Contact us by text or phone at (918) 245-1301.

- For a list of text commands, text ‘HELP’ to 39872

To stop Text Banking messages from coming to your phone, opt out by texting ‘STOP’ to 39872. You will receive a one-time opt-out confirmation text message and will not receive further messages after that.

By participating in Mobile Banking & Text Alerts, you are agreeing to the terms and conditions presented above. Our participating carriers include (but are not limited to) AT&T, Sprint, T-Mobile, US Cellular, Verizon Wireless, MetroPCS. Mobile Banking and any software you may obtain from mobile banking (“Software”) may not be available at any time for any reason outside of the reasonable control of Green Country FCU or any service provider.

Our online banking and mobile banking Apps employ a host of solutions to keep your money safe and ensure that online validated members login.

Multi-Factor Authentication

Our Login steps for Online and Mobile Banking have a wealth of security measuers in place “behind the scenes” that keeps your information secure and protected. Additionally, we require multi-factor authentication to login and to move money. This allows your login attempt to be authenticated via an automated voice call or a text message (you select) that delivers a one-time passcode to start your online banking session.

Security Questions

All those security questions you set up when you start your online banking or mobile banking account, also provide additional layers of security for you accounts.

What makes our payments products and services safe? In addition to educating our employees and you, our members, we use multiple protocols and features to help protect the integrity of your information.

Digital Bill Payments

- Fraud-Detection and Monitoring Systems

A multi-layered automatic system that monitors all aspects of outgoing digital bill payments. If suspicious activity is detected, the payment is flagged and reviewed by fraud analysts. - Enhanced Activity Controls

With a network of thousands of FIs that can anonymously report on fraud data, each report makes the system smarter as it tracks consumer history and behaviors and looks out for any fraud telltale signs across all transactions - IP Reputation-Based Controls

Security systems in place can detect IP addresses that are suspected to be associated with fraudulent activities and block them from connecting to financial institution servers

Account-to-Account Transfers

- Real-Time Account Verification

Ability to verify external accounts through instant and real-time verification. - Industry-Leading Risk Management

Provided by our core provider, protects you with fraud prevention and risk monitoring.

Zelle Payments

- Real-Time Data Enrichment

External and internal data is gathered and sourced in order to improve fraud detection and reduce false positives. - Robotic Process Automation

Automated actions help stop mule activity and can perform link analysis and fraud suspensions. - Mature, Flexible Risk Systems

This is a risk and product roadmap that keeps pace with ever-changing fraud patterns.

Money Manager

- Secure Portal for Financial Data

A secure place for you to share their information to third-party applications, while simplifying the complexities of an expanding aggregation market. - Protect Accountholder Data

Keeps all customers’ information safe within our firewall and won’t require you to share credentials with third-party applications to connect their account. - VerifyNow

Reduces fraud with real-time verification and authentication of account ownership, status and consumer identity.

ATTENTION INTUIT USERS – QuickBooks & Quicken.

Green Country FCU is upgrading to a new online and mobile banking system on August 17, 2023. This update will require that you make changes to your QuickBooks or Quicken software, so please take action to ensure a smooth transition.

There are three ways that Green Country online banking accounts connect to Intuit products. Two of them connect automatically, the third requires a manual upload. We’ll explain more about those connections below.

Regardless of your connection type, it is recommended that you create a data file backup prior to the conversion. Detailed instructions for this process are listed at the links below.

Conversion instructions:

Steps for conversion:

- A data file backup and a final transaction download should be completed by end of day August 15th. Please make sure to complete the final download before this time as the current system will not be accessible after 4:00 p.m. on the 16th.

- Web Connect & Direct Connect: August 17, 2023 after 12:00 p.m. – You will need to deactivate/reactivate your online banking connection to ensure that your current QuickBooks or Quicken accounts can reach the new connection.Aggregation (Express Web Connect): August 22 – You will need to deactivate/reactivate your online banking connection to ensure that your current QuickBooks or Quicken accounts can reach the new connection.

Intuit aggregation services may be interrupted for up to 3-5 business days after conversion on the 17th. You are encouraged to download a QFX/QBO file during this outage. The following services may not work during the downtime:

- Quicken Win/Mac Express Web Connect

- QuickBooks Online Express Web Connect (Aggregation)

- Mint

Please carefully review your downloaded transactions after completing the migration instructions to ensure no transactions were duplicated or missed on the register.

Unsure what connection type you have? Unfortunately, we cannot see the connection on our side nor do we have a list from Intuit of users. But we can provide this guidance:

- Web Connect. This requires manually downloading a QBO or QFX file from online banking and uploading it into your Intuit product. Available on QuickBooks Desktop, QuickBooks Online and Quicken. Will be available on live date of conversion.

- Direct Connect. This is an automatic, two-way communication between your Intuit product and online banking. It allows for your online banking bill pay to be incorporated into Intuit. This connection has to be refreshed to grab new information. Available on QuickBooks Desktop and Quicken. Will be available on live date of conversion.

- Aggregation (Express Web Connect). This is an automatic connection between Intuit and online banking. Available for QuickBooks (Win/Mac 2022, QuickBooks Online, Mint and Quicken). This connection takes 3-5 days after go live to populate on Intuit’s servers.

If you have questions, please email Ashley Wood at [email protected]. It will be most helpful in troubleshooting your connectivity issues if you include:

- Your Green Country account information

- Business Name associated with the Intuit product

- The type of Intuit product you are using (QuickBooks Desktop, Online, etc.)

- Any error you are receiving + a screenshot of the error if possible

- The best way to get a hold of you

We want to support you the best we can through this process. If you would please take a moment to let us know what Intuit service you use with your Online Banking from Green Country FCU, we will include you in communications moving forward. RESPOND TO INTUIT SURVEY

Thank you!

Did you know you can connect your Green Country accounts to QuickBooks, Quicken & Mint?

Intuit offers two OFX connection types that allow your customers to access and control their online banking data from within Quicken and QuickBooks desktop products. Over 90% of the top 150 U.S. banks use one (or both) of these proven solutions:

- Direct Connect provides automatic connectivity that allows customers to instantly view their balances, transfer between accounts, pay bills, and download transactional data into Quicken and QuickBooks.

- Web Connect offers customers manual control over their data feed, as they export from your website and import their transactions and account balances into Quicken and QuickBooks.

Connectivity Benefits

No manual data entry: Once set up, you can download all their transactions right into Quicken or QuickBooks.

Automatically reconcile data: Complete transaction and balance information makes categorization and account reconciliation easy.

No duplicate transactions: A special transaction-matching algorithm prevents duplicate transactions.

Easier to use: Files may be automatically opened directly from Green Country’s website – no more searching for saved files.

Automatic account setup: The first time that customers initiate a download from Green Country, Quicken and QuickBooks will set up their accounts for them—with their data already up to date.

Green Country FCU does not sell Intuit products. To purchase QuickBooks, Quicken, TurboTax, Mint, CreditKarma or more, please visit https://www.intuit.com/.

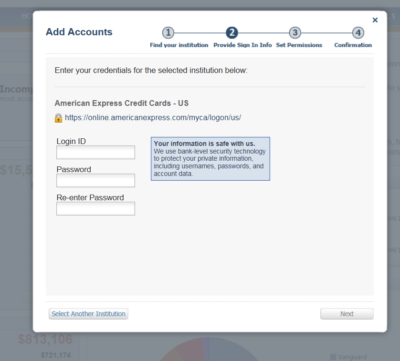

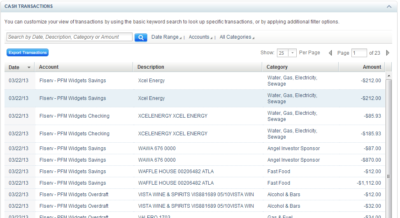

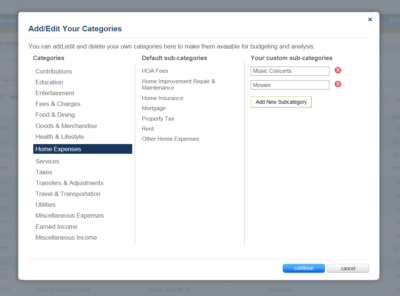

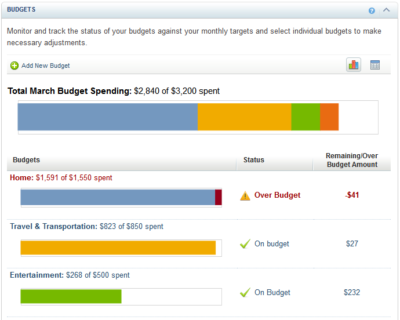

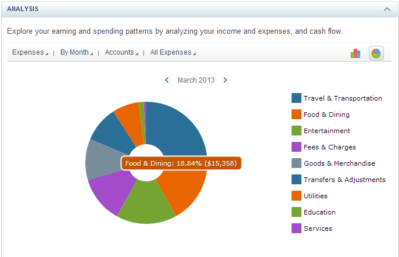

Money Manager is a free, personal financial management system connected to your online banking accounts.

Money Manager:

- Provides consolidated, 360-degree view of Green Country and other financial institution accounts (once linked)

- Allows you to track spending, net worth, budgets, and goals

- Financial Management Tools help you understand, manage and gain control of your finances

- Offers financial and savings advice as well as educational articles

Money Manager is best viewed on a desktop in Microsoft Edge, Google Chrome or Mozilla Firefox. Safari users should adjust privacy preferences to uncheck “prevent cross-site tracking” and uncheck “block all cookies” to for optimal viewing.

It’s super easy to use!

Mobile Deposit puts banking in your hands, just log in, take a picture, and deposit!

- Endorse checks with your signature and “For mobile deposit only, GCFCU”

- Hang on to the paper check until funds are posted to your account

- It’s good practice to keep them for 90 days

- Deposit status may not show up immediately, login later in the day to check

- Deposits should post same “business” day but can take up to 3 days to process

- Check holds and funds availability still apply

- Business day cutoff time is 4:00 p.m.

Check Your Balance at a Glance with Instant Balance

Did you know that you can check your account balance without logging into the mobile app? Instant Balance gives you one-click access to your account balance on your mobile phone.

Ready to set it up?

- Login to your mobile app and select ‘Instant Balance’ from settings

- Turn ON Instant Balance by moving the selector right (it will be green)

- Enter your password again and select the account(s) to show Instant Balance

- you can select one account or multiple

- Log Out of the mobile App after you see the “You’re ready to go!” page

Now you’re signed up! And you can turn it off at any time.

To see your Instant Balance, open the mobile app, and BEFORE you login, click on the Instant Balance button.

Get your monthly Green Country FCU statement via email and access it anytime in Online Banking.

Signing up for e-statements is easy and you can do it anytime, online!

Login to Online Banking (https://online.greencountryfcu.com)

![]()

![]()

![]()

![]()

![]()

Get savvy about your money with Credit Sense

Credit Sense is a free, comprehensive Credit Score program offered by Green Country FCU that helps you stay on top of your credit. You get your latest credit score and report, an understanding of key factors that impact the score, and can see the most up-to-date offers that can help reduce your interest costs. With this program, you always know where you stand with your credit and how your Bank can help save you money.

Credit Sense is integrated into online and mobile banking so you’ll see your information when you login. To dive in deeper, click through the pages to see your full information. You can refresh your credit score every 24 hours manually, or it will automatically refresh for you every 7 days.

Features:

- Score Analysis measures 5 items that impact credit score. Each with a grade that you can click through for a deeper understanding.

- Your credit score action plan looks at your score analysis to find opportunities to improve.

- Education links

- Credit Monitoring will alert you of changes to your credit report

- Credit Reports can be downloaded to a PDF

- Submit a dispute if you find an error in your report

- Score Simulator shows you how actions will affect your credit score.

- Credit Goals

Frequently Asked Questions

What is Credit Sense?

Credit Sense is a comprehensive Credit Score program offered by your Bank, that helps you stay on top of your credit. You get your latest credit score and report, an understanding of key factors that impact the score and can see the most up-to-date offers that can help reduce your interest costs. With this program, you always know where you stand with your credit and how your Bank can help save you money.

Credit Sense also monitors your credit report daily and informs you by email if there are any big changes detected such as: a new account being opened, a change in address or employment, a delinquency has been reported or an injury has been made. Monitoring helps users keep an eye out for identity theft.

2. What is Credit Sense Credit Report?

Credit Sense Credit Report provides you all the information you would find on your credit file including a list of open loans, accounts, and credit inquiries. You will also be able to see details on your payment history, credit utilization, and public records that show up on your account. Like Credit Score, when you check your credit file, there will be no impact to your score.

3. Is there a fee?

No. Credit Sense is entirely free and no credit card information is required to register.

4. How often is my credit score updated?

As long as you are a regular online banking user, your credit score will be updated every month and displayed in your online banking screen. You can click “refresh score” as frequently as every day by navigating to the detailed Credit Sense site from within online banking.

5. How does Credit Sense differ from other credit scoring offerings?

Credit Sense pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

6. Why do credit scores differ?

There are three major credit-reporting bureaus—Equifax, Experian and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be taken into account when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical. No matter what credit bureau or credit scoring model is used, consumers do fall into specific credit ranges: Excellent 781–850, Good 661-780, Fair 601-660, Unfavorable 501-600, Bad Below 500.

7. Will Green Country FCU use Credit Sense to make loan decisions?

No, Green Country FCU uses its own lending criteria for making loan.

8. Will Credit Sense share my credit score with Green Country FCU?

No, Credit Sense is a free service to help you understand your credit health, how you make improvements in your score and ways you can save money on your loans with Green Country FCU.

9. How does Credit Sense keep my financial information secure?

Credit Sense uses bank-level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party.

10. If the Credit Union doesn’t use Credit Sense to make loan decisions, why do we offer it?

Credit Sense can help you manage your credit so when it comes time to borrow for a big-ticket purchase—like buying a home, car, or paying for college—you have a clear picture of your credit health and can qualify for the lowest possible interest rate. You’ll also see offers on how you can save money on your new and existing loans with Green Country FCU.

11. What if the information provided by Credit Sense appears to be wrong or inaccurate?

Credit Sense makes its best effort to show you the most relevant information from your credit report. If you think that some of the information is wrong or inaccurate, we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.com, and then pursuing with each bureau individually. Each bureau has its own process for correcting inaccurate information but every user can “File a Dispute” by clicking on the “Dispute” link within their Credit Sense Credit Report. However, The Federal Trade Commission website offers step-by-step instructions on how to contact the bureaus and correct errors.

12. There is a section on the site that features both Green Country FCU product offers and financial education articles. Why am I seeing this?

Based on your Credit Sense information, you may receive Green Country FCU offers on products that may be of interest to you. In most cases, these offers may have lower interest rates than the products you already have. The educational articles, written by the Credit Sense team, are designed to provide helpful tips on how you can manage credit and debt wisely.

13. Will accessing Credit Sense ‘ping’ my credit and potentially lower my credit score?

No. Checking Credit Sense is a “soft inquiry”, which does not affect your credit score. Lenders use ‘hard inquiries’ to make decisions about your creditworthiness when you apply for loans.

14. Does Credit Sense offer credit report monitoring as well?

Yes. Credit Sense will monitor and send email alerts when there’s been a change to your credit profile.

15. How do members change their email address or other personal information?

If you access Credit Sense program through your online banking, you have to do nothing! Your email address will get updated automatically in Credit Sense when you update it in online banking. However, we always encourage you to inform your financial institution of any contact information updates.

16. Can Members use Credit Sense on mobile devices?

Yes, Credit Sense is available for both mobile and tablet devices and is integrated into our mobile banking application.

Green Country FCU Online Banking is the one place to pay all your bills. Simplify your finances by keeping track of everything together. This free service allows you to find and add bills to pay, add payees, schedule one-time or recurring payments, and more from online banking and our mobile banking apps. Additionally, members now have the added benefit of same-day payments and overnight payments for a rush fee.

- Pay anyone in the United States that you would normally pay by check, automatic debit, or cash. We send the money electronically whenever we can, If the person or company can’t accept electronic payments, we print a check and mail it for you.

- Set up automatic payments to be sent according to a schedule you set. You can change or cancel AutoPay at any time.

Existing Bill Pay users should see their pre-existing bills, payees, future-dated payments, and recurring payments already loaded into your user profile. However, bill pay history prior to the August 17 conversion date will not be available.

New Features:

- Bill Discovery, which enables the automatic searching, identification, and retrieval of information about some payees and bills based on your identity.

- Zelle P2P payments is another new feature for Bill Pay. Members can make, receive, or split payments with other people using by mobile phone.

- Bill Pay support is available by phone from 6:00 a.m. until midnight CST at (866) 960-2394, 7 days a week.

- Overnight Checks $14.95

- Same Day Bill Pay $9.95

If you’re new to Online Bill Pay, it’s easy to get started. Login to online banking and navigate to the Payment Center. You’ll be prompted to agree to the terms and conditions of Bill Pay and then given options to find your bills using Bill Discovery or adding payees manually.

For a full list of frequently asked Bill Pay questions, please click here to view a FAQ PDF or login to Online Banking and review the Frequently Asked Questions inside Bill Pay (easier to navigate).

Download our FREE mobile app for your smartphone

Our apps provide a simple yet powerful tool for staying connected to your accounts anytime, anywhere.

Mobile App Features:

- Quick Login with fingerprint or Apple Face ID

- View Instant Balance without logging in

- Deposit checks with mobile deposit

- On-device enrollment

- Transfer Funds between accounts

- Pay Bills

- Check your credit score

- Reorder or name your accounts

- Access commonly used Credit Union forms:

- loan application

- new account application

- skip-a-pay form

- travel notice

- address change

- and more

Mobile banking app users must have an online banking account with Green Country FCU.

After downloading and launching the app, you will be required to login with your online banking account credentials. If you do not already have a online banking account, you will be given the option to create one from the login screen. Users who do already have online banking accounts will have all of their account information imported automatically upon logging in to the mobile banking app.

How do I create an online banking account using the app?

- Download the latest version of the app.

- After launching the app, you will be directed to a login screen.

- On the login screen, select the “First Time User? Enroll Now” option.

- Walk through the on-screen instructions to create your digital banking account.

Account Alerts in Online Banking are an easy way to keep track of your accounts!

Set alerts to text or email you when:

- Your balance drops below (or grows above) a specific amount

- A direct deposit posts

- An ATM withdrawal or debit transaction exceeds a specific amount

- A check has cleared

- A withdrawal exceeds a specific amount

- You’ve received a secure message from the Credit Union

You can also set a balance reminder via text or email to alert you of your current balances daily.

To set an alert inside online banking with Green Country FCU,

- Login to Online Banking

- Click on the 3 dots next to the account you want the alert on and select ‘Alerts’ -or-

Click on the account name/number you want the alert on to open the Account Details page - Select the alert you’d like

- Select the account the alert should apply to

- Select the delivery method – text or email

*At this time, alerts can only be set in the online banking desktop interface, not in the mobile app.

All checks deposited through the mobile app should be endorsed with two items:

- Your signature

- “for mobile deposit only, GCFCU”

Mobile Deposit puts banking in your hands, just log in, take a picture, and deposit!

- Members must request Mobile Deposit to be turned on.

- Call or Text (918) 245-1301 or email [email protected].

- Endorse checks with your signature and “For mobile deposit only, GCFCU”

- Hang on to the paper check until funds are posted to your account

- It’s good practice to keep them for 90 days

- Deposit status may not show up immediately, login later in the day to check

- Deposits should post same “business” day but can take up to 3 days to process

- Check holds and funds availability still apply

- Business day cutoff time is 4:00 p.m.

Shared branching is one of the coolest perks of the Credit Union! Essentially, when you have an account with Green Country FCU, you can conduct banking business at ANY CO-OP Shared Branch location. Yes, that includes our “competitors” like TTCU, Red Crown, Oklahoma Central and more. Traveling? No problem, we’re nationwide!

Credit Unions are cooperative organizations that are owned and operated by the people who use them so it’s natural that we work together. Need to make a payment on your loan, transfer money, cash a check – there are so many things you can do at a Shared Branch.

The CO-OP network has more than 5,600 branch locations and more than 30,000 surcharge-free ATMs.

You can also Text a zip code to 91989 to find nearby ATM and Shared Branch Locations or call 888-748-3266.

And because Green Country is a member of the CO-OP Shared network, if you have accounts at other credit unions, we can help you with those also. Visit us today!

We get this one a lot! Fortunately, there are many ways to check your account balance or other transaction specifics on your account, anytime, anywhere!

- Online Banking

- Login anytime to manage your money: https://bit.ly/GCFCU

- Don’t have an account yet? Start here.

- Mobile App

- With Green Country’s mobile app, you can access your accounts, move money, check your balance, and more from anywhere, anytime.

- Download Now

- Text Alerts

- When enrolled, text ‘BAL’ to 39872 to receive your balance.

- You can also set up recurring alerts to get your balance sent to you every day – like setting an alarm!

- How to Enroll in Text Alerts

- 24/7 Phone Banking

- Call Anytime for touch-button banking – (877) 435-4370.

- How to Enroll in Voice Banking

- Voice Banking Call Menu

- ATMs

- Yes, you can check your balance at the ATM as long as you have your debit/ATM card. Green Country FCU is part of the Transfund network and most ATMs are surcharge-free for transactions. Checking your balance should not be considered a transaction even at out-of-network ATMs but please be sure to read all notices on the machine and screens.

As always, you can bank at any Green Country FCU branch or Shared Branch location (find one near you); or call/text us for help during business hours (Monday-Friday 9:00 a.m. – 4:30 p.m.) at (918) 245-1301.

With Text Banking you can quickly request your balance, transfer money, check history to see if a check has cleared, or find an ATM or Branch nearby. You can also set text alerts to tell you what your balance is daily, alert you of incoming/outgoing ACH, large deposits/withdrawals, etc.

Members will have to be enrolled in text banking/alerts. You can do this yourself inside online banking – check out the instructions here: https://greencountryfcu.com/faq-items/how-to-enroll-in-text-banking/

If you don’t see the self-service options for mobile banking, call or text us at (918) 245-1301 and we’ll get you set up.

Green Country FCU Self-Service Text Banking

Text to 39872

- BAL for balance

- this will show your account nicknames and balances for all enrolled accounts

- HIST + texting account nickname for recent transactions

- ATM + zip for nearby ATMs

- BRANCH + zip for nearby branches

- STOP to Cancel texting service

- HELP for list of options

Green Country FCU offers members mobile access to account information (e.g., for checking balances and last transactions) over SMS, as well as the option to set up alerts for accounts (e.g., low balance alerts). Enrollment requires identification of the user’s banking relationship as well as providing a mobile phone number. The mobile phone number’s verification is done by the user receiving an SMS message with a verification code which they will have to enter on the website. Additionally, members may select the type of alerts and other preferences which will determine, together with their account data, the frequency of alerts delivered to the customer. This program will be ongoing. Message & Data rates may apply. Members can opt-out of this program at any time.

Questions about Text Alerts?

• Contact us by text or phone at (918) 245-1301.

• For a list of text commands, text ‘HELP’ to 39872

To stop Text Banking messages from coming to your phone, opt out by texting ‘STOP’ to 39872. You will receive a one-time opt-out confirmation text message and will not receive further messages after that.

By participating in Mobile Banking & Text Alerts, you are agreeing to the terms and conditions presented above. Our participating carriers include (but are not limited to) AT&T, Sprint, T-Mobile, US Cellular, Verizon Wireless, MetroPCS. Mobile Banking and any software you may obtain from mobile banking (“Software”) may not be available at any time for any reason outside of the reasonable control of Green Country FCU or any service provider.[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

Video Instructions:

or follow these steps:

- LOGIN to Online Banking

- Select Mobile from the Upper Right Menu

- Click “Add New Device” from the “Manage Mobile Banking Devices” page

- Add your mobile phone number under “Other Services” and select Continue

- Select the “Text Messaging” box then select Continue

- Enter the Activation Code you receive on your mobile device

- Success!

Green Country FCU offers members mobile access to account information (e.g., for checking balances and last transactions) over SMS, as well as the option to set up alerts for accounts (e.g., low balance alerts). Enrollment requires identification of the user’s banking relationship as well as providing a mobile phone number. The mobile phone number’s verification is done by the user receiving an SMS message with a verification code which they will have to enter on the website. Additionally, members may select the type of alerts and other preferences which will determine, together with their account data, the frequency of alerts delivered to the customer. This program will be ongoing. Message & Data rates may apply. Members can opt-out of this program at any time.

Questions about Text Alerts?

• Contact us by text or phone at (918) 245-1301.

• For a list of text commands, text ‘HELP’ to 39872

To stop Text Banking messages from coming to your phone, opt out by texting ‘STOP’ to 39872. You will receive a one-time opt-out confirmation text message and will not receive further messages after that.

By participating in Mobile Banking & Text Alerts, you are agreeing to the terms and conditions presented above. Our participating carriers include (but are not limited to) AT&T, Sprint, T-Mobile, US Cellular, Verizon Wireless, MetroPCS. Mobile Banking and any software you may obtain from mobile banking (“Software”) may not be available at any time for any reason outside of the reasonable control of Green Country FCU or any service provider.

Green Country members can reorder checks by phone, online or in-person at any Green Country branch.

- Phone: Call member services at (918) 245-1301 and press 3

- Online: Click Here to Order Checks

Green Country FCU Morrow Rd. branch

Lobby: Monday – Friday 9:00 a.m. – 4:30 p.m.

Drive-Thru: Monday – Friday | 8:30 a.m. to 5:30 p.m.

Green Country FCU Prattville branch

Lobby: Monday – Friday 9:00 a.m. – 4:30 p.m.

Drive-Thru: Monday – Friday | 8:30 a.m. to 5:30 p.m.; Saturday 9:00 a.m. – noon

Green Country FCU Coweta branch

Lobby: Monday – Friday 9:00 a.m. – 5:00 p.m.

With Message Pay, you can make a payment to your Green Country loan from an external financial institution account or debit card. When you receive a text reminder, you respond “Pay” to the same text. You will be asked to enter your pin to verify your account, once you have completed this process your payment will be complete and you should receive a confirmation text. You will have to set up a 4-digit pin and preferred method of payment prior to using text payments.

Opt-In to Message Pay for your Green Country loan by texting “START” to (918) 995-4508.

First-time users, click on the link in the text or start online here. You’ll be prompted to verify your account with your loan account number and date of birth. If this is a business account, the birthdate is your company’s. You’ll then be prompted to set up:

- A 4-digit PIN: this is how you’ll verify future payments

- A preferred method of payment: You can add a non-Green Country FCU debit card or bank account.

Once verified, you’ll be directed to the message pay portal where you’ll see your Green Country loans and be able to select your preferred payment method. Beginning September 1, 2023, there is a $4.99 per payment fee to make a payment using MessagePay but the monthly alerts are free.

You can make payments from your Green Country accounts or another financial institution’s accounts.

FROM YOUR GREEN COUNTRY CHECKING OR SAVINGS ACCOUNT:

- ONLINE: login to Online Banking (GreenCountryFCU.com, click Login) and make or schedule a transfer (one-time or recurring) from your payment account to your loan account

- IN PERSON: visit any Green Country FCU branch or any Co-Op Shared Branch or any Credit Union Service Center

- MAIL: Mail a check to 202 E. Morrow Rd., Sand Springs, OK 74063

- PHONE: During business hours, call or text (918) 245-1301. After business hours, call the anytime voice banking line (877) 435-4370, select 3 to perform a transaction activity, and follow the prompts. You will need your member number and PIN to use the anytime voice banking line.

FROM AN EXTERNAL ACCOUNT (Another Financial Institution):

- Use Message Pay online to pay your Green Country loan from another financial institution here: https://greencountryfcu.messagepay.com/payment/accountlookup

- Message Pay sends monthly alerts that your payment is due and you can pay via text or online. Payments made through Message Pay are $4.99; alerts are free.

- Set up a recurring ACH from another financial institution to your Green Country loan by submitting an ACH request form here.

- IN PERSON: Visit any Green Country FCU branch or any Co-Op Shared Branch or any Credit Union Service Center

- MAIL: Mail a check to 202 E. Morrow Rd., Sand Springs, OK 74063

- PHONE: During business hours, call or text (918) 245-1301

Message Pay is a quick, easy, mobile payment portal for your Green Country FCU loans. You can make a payment to your Green Country loan from any non-Green Country FCU account by text message or online. All Green Country members with an active personal loan and a mobile phone will receive a text message allowing you to sign up for Message Pay.

First-time users will need to verify and then set up your account.

You’ll receive a text from (918) 995-4508 with instructions on how to set up. If you do not receive this message before your first loan payment is due, you can opt-in manually but texting “start” to (918) 995-4508, or enrolling online here.

- To verify, enter your loan account number and date of birth.

- Configure your account by setting a 4-digit PIN (you’ll use this to verify text payments in the future), and adding a preferred method of payment.

- You have the option to link a bank account or add a credit/debit card.

- Message Pay is for payments made to Green Country loans from another financial institution account, not your Green Country checking account.

- There is a $4.99 fee to make a payment with Message Pay.

- Text alerts are free.

- If you want to pay from a Green Country account, it’s still easiest for you to transfer money to your loan account from your Green Country checking account inside online banking. You can make a one-time transfer, or set recurring transfers to happen monthly.

Your payment will be posted to your account within one business day. For example, if you make your payment on a Saturday, your payment will be posted Monday morning. Likewise, if you make your payment at 5:00PM on a Monday, your payment will be posted on Tuesday morning.

Green Country’s routing number is #303185761

Yes! If you notice a charge on your statement or online banking transaction history that is incorrect or not yours, you need to file a dispute.

- Call us (918) 245-1301 or come by any of our branches.

- We’ll help you with the dispute form and turn off your debit card/cancel checks so no other charges can come through.

Well, we offer all of the same products as banks, but we don’t have any outside shareholders. Instead, our members are our shareholders. That means our profits are reinvested in you, giving you more for your money.

Not-for-Profit. Credit unions return earnings to members in the form of higher interest rates on savings products, lower interest rates on loans and credit cards, and added services.

Member-Owned and Operated. A credit union’s board of directors is elected by the members, and each member has an equal vote.

Better Service. Members are the owners, so credit unions place a heavy emphasis on excellent customer service, financial education, and community involvement. See what Consumer Reports has to say about credit union customer service.

Accessible. Credit unions offer mobile banking and large, robust ATM and branch networks that make it easy for members to access their money anytime, anywhere.

Lost your Green Country FCU VISA debit card, or suspect it’s been compromised?

Give us a call, or text us at (918) 245-1301 and let us know so we can cancel your current card and get a new one.

If it’s after business hours, please call (855) 961-1602 and follow the prompts.

If you’re concerned you’re the victim of Identity Theft or Fraud, please check out these additional resources: https://greencountryfcu.com/identity-theft-recovery/

You can also call the Federal Trade Commission, ID Theft Hotline at 877.ID.THEFT or 877.438.4338.

Typically, new debit cards will take 7 – 10 days by USPS mail and will be directly mailed to the address you have on file with us. The PIN number for your card will be mailed separately and sometimes beats the debit card to your house!

Your Green Country FCU membership number is your unique profile number that is typically 6 digits long. This number will help our employees identify you and your associated accounts for faster service.

Each Green Country account that you open has an associated share ID – or account number. Your account number links us to one specific account – savings, checking, loan, CD, etc. Your membership numbers link to your entire group of accounts with us.

Setup Online Banking

Enrolling in Online Banking is quick and easy. Please note that you do have to enroll and login on a desktop before you can access our mobile banking app. You will need your member number for this step.

Not sure what your member number is? Call or text us at (918) 245-1301 during business hours.

Step 1 of setup:

- In a new browser window go to https://bit.ly/GCFCU (or click on Login to Online Banking from our website homepage – www.GreenCountryFCU.com).

- Click “Enroll” under First Time User

- Enter you Member Number and PIN (last four SSN).

- Click on the Blue “Terms and Conditions” link to read. Close that pop-up (or set it aside for later reading) and then check the “Terms and Conditions” box.

- Prove that you’re not a Robot by completing the Captcha puzzle and then press “continue”.

You will then be redirected to fill out your security questions, security phrase, and user settings.

Step 2 of setup:

- Edit Challenge Questions

- You will get a “challenge questions changed successful” message and need to select “OK” button to move forward.

- Edit Security Phrase

- You will get a “security phrase changed successful” message and need to select “OK” button to move forward.

- Update Demographic Information

- You have the option to “Update”, “Remind Me Later” or select “No Change”. You can also ignore this message altogether and click the Blue Menu Bar Options

If you update demographic information or click “self-service”, your next page will be the online banking overview page.

If you select “OVERVIEW”, you will be prompted to Update your Preferences which allows you to modify what you see on your overview page.

You’re now enrolled and logged in.

- Set up Mobile Banking

- Quick Links: Download Mobile App

- Set up Text Banking/Alerts

Green Country – as with other Credit Unions – differs from banks in that every account holder is a MEMBER. And we are MEMBER-OWNED. Meaning, you have a say in how the credit union is run, and you can vote on various issues and the Board of Directors. It doesn’t matter if you have more or less money than anybody else in your account – every member is treated equally.

Also, each member is required to have a Primary Share Savings Account to be eligible for any other Green Country FCU product or service. Your Primary Share Savings account can be opened with as little as $5 and must retain at least $5 in it at all times to remain open.

Additionally, you will have a Share Savings account for each Draft account you open. This makes it easy to set up direct deposit and automatic transfers to make saving effortless.

(If you’re used to bank terminology – a share savings account is similar to a savings account – ours pay Dividends (like banks pay interest).

Share Draft accounts are the same as a checking account – completely liquid accounts for payments and everyday spending.

To apply for Green Country FCU membership, you’ll need the following forms of identification:

- Valid U.S. government issued ID (e.g. Driver’s License, Passport, or State ID) or Foreign Passport

- Social Security Number (SSN) or Individual Tax Identification Number (ITIN)

- Documentation verifying your home address, such as a utility bill or lease agreement (Not required for minors 17 and under)

- If you’re applying for first-time membership and your relative or domestic partner is a member, you will need his/her first and last name. Providing a current membership and/or account number is optional.

You are eligible to join Green Country FCU if you:

- Are an immediate family member or a domestic partner of a current Green Country FCU member.

- Live, work, worship or attend school in the Tulsa, OK Metropolitan Statistical Area consisting of Creek, Okmulgee, Osage, Pawnee, Rogers, Tulsa and Wagoner Counties.

Joining Green Country FCU is easy. Complete our secure online membership application.

<link: https://greencountryfcu.com/Applications-and-Forms/Membership-Application.aspx>

Or, you can download our PDF application and mail to:

Green Country FCU

ATTN: New Accounts

202 E. Morrow Rd.

Sand Springs, OK 74063

Or, stop by one of our branches to apply in person.

Sand Springs/Prattville

202 E. Morrow Rd. (map) 3350 S. 113th W. Ave. (map)

Sand Springs, OK 74063 Sand Springs, OK 74063